Lexus IS 300h Ready To Lead The Field On Ownership Costs

KEY POINTS

- New IS 300h’s full hybrid powertrain set to deliver excellent durability and low maintenance and running costs, unmatched by diesel rivals

- Fuel and tax savings thanks to 65.7 mpg* combined cycle economy and 99g/km CO2 emissions for the IS 300h SE

- Strong residual values of 37 per cent predicted by CAP for predicted best-selling Luxury grade.

The all-new Lexus IS 300h will offer customers cost of ownership advantages unmatched by any of its 2.0-litre diesel rivals in the premium saloon market, thanks to the combination of low maintenance and running costs and tax benefits and incentives secured by its efficient full hybrid powertrain.

Its Lexus Hybrid Drive powertrain – featured in an IS saloon for the first time – provides not only distinctively quiet and smooth performance, but exceptional fuel economy and low emissions, too: the IS 300h SE model comes with official combined cycle figures of 65.7mpg and 99g/km CO2.

Low service, maintenance and repair costs

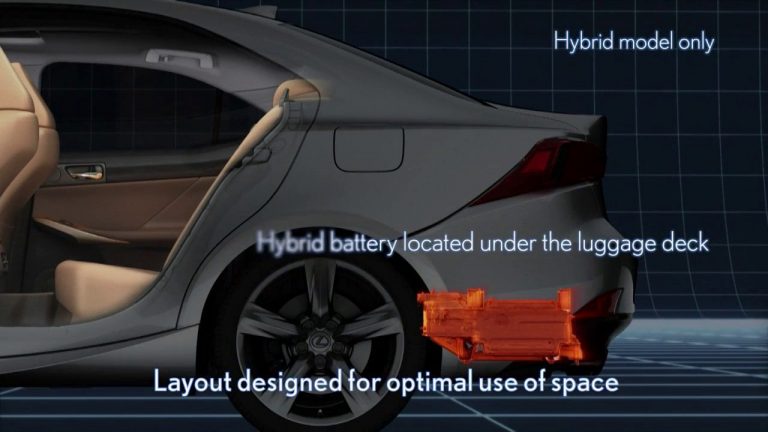

The IS 300h’s hybrid system is engineered for durability and low maintenance requirements. It has no clutch; the starter motor and alternator are integrated into the system, so require no servicing or replacement during the vehicle’s lifetime; and instead of a timing belt it uses a maintenance-free timing chain.

For owners this means lower servicing bills and savings on replacement parts.

Lexus Hybrid Drive also has an impact on brake and tyre wear: the system’s regenerative braking delivers the initial braking force, which significantly reduces wear on pads and discs.

Lexus hybrids run with 20 per cent higher tyre pressure, which helps reduce shoulder wear. The smooth, linear power delivery and the IS’s balanced weight distribution also means less wear on the front tyre treads.

Compared to rival 2.0-litre diesel automatic models from BMW, Mercedes-Benz and Audi the IS 300h is expected to offer savings on service, maintenance and repair costs alone of up to £443 over three years*, reflecting the reduced labour time required.

Tax advantages

Thanks to its sub-100g/km emissions performance, the IS 300h SE will benefit from a number of personal and business tax advantages, not least a zero annual road tax (Vehicle Excise Duty) charge.

Low benefit-in-kind company car tax rates mean a 40 per cent tax payer is likely to pay as much as £923 a year less than the driver of a new Audi A4 2.0 TDI SE Multitronic over the first three years of ownership*.

Likewise a business adding the hybrid Lexus to its fleet will appreciate the lower VED, fuel, insurance and service, maintenance and repair costs.

Residual value

Lexus Hybrid Drive has built a strong reputation for performance and reliability and as a credible, environmentally efficient alternative to conventional petrol and diesel powertrains. This has helped establish strong residual values, reflected in CAP’s projected 37 per cent (after three years 60,000 miles) figure for the IS 300h Luxury, predicted to be the best-selling grade.

The new IS range will be launched in the UK in July, with prices for the IS 300h starting at £29,495 for the SE version.

* Data from KwikCarCost and Lexus

ENDS

Ref:130415DM